Real Estate Bonus Depreciation 2025. The percentage you can deduct depends on the year, as 100% bonus depreciation was phased out in 2025. Prior to enactment of the tcja, the additional first year depreciation deduction applied only to property where the original use began with the taxpayer.

Extension of 100% bonus depreciation. The tax cuts and jobs act (tcja) included a statute stating that qualified purchases made between september 27, 2017, and january 1,.

Bonus Depreciation 2025 Bonus Depreciation on Real Estate, For 2025, businesses can take advantage of 80% bonus depreciation. This gradual reduction brings a new set of challenges and opportunities for 2025 and beyond.

Auto Bonus Depreciation 2025 Donni Gaylene, The percentage you can deduct depends on the year, as 100% bonus depreciation was phased out in 2025. Taking the 80% bonus depreciation for an asset in 2025 is not eligible for the remaining 20% in 2025.

Real Estate and Tax Reform A High Level Analysis Sikich LLP, The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service. The percentage you can deduct depends on the year, as 100% bonus depreciation was phased out in 2025.

Real Estate Tax Depreciation 101, You can only claim the asset’s standard depreciation. Residential rental property is depreciated over 27.5 years, while commercial real estate is depreciated over a period of 39 years.

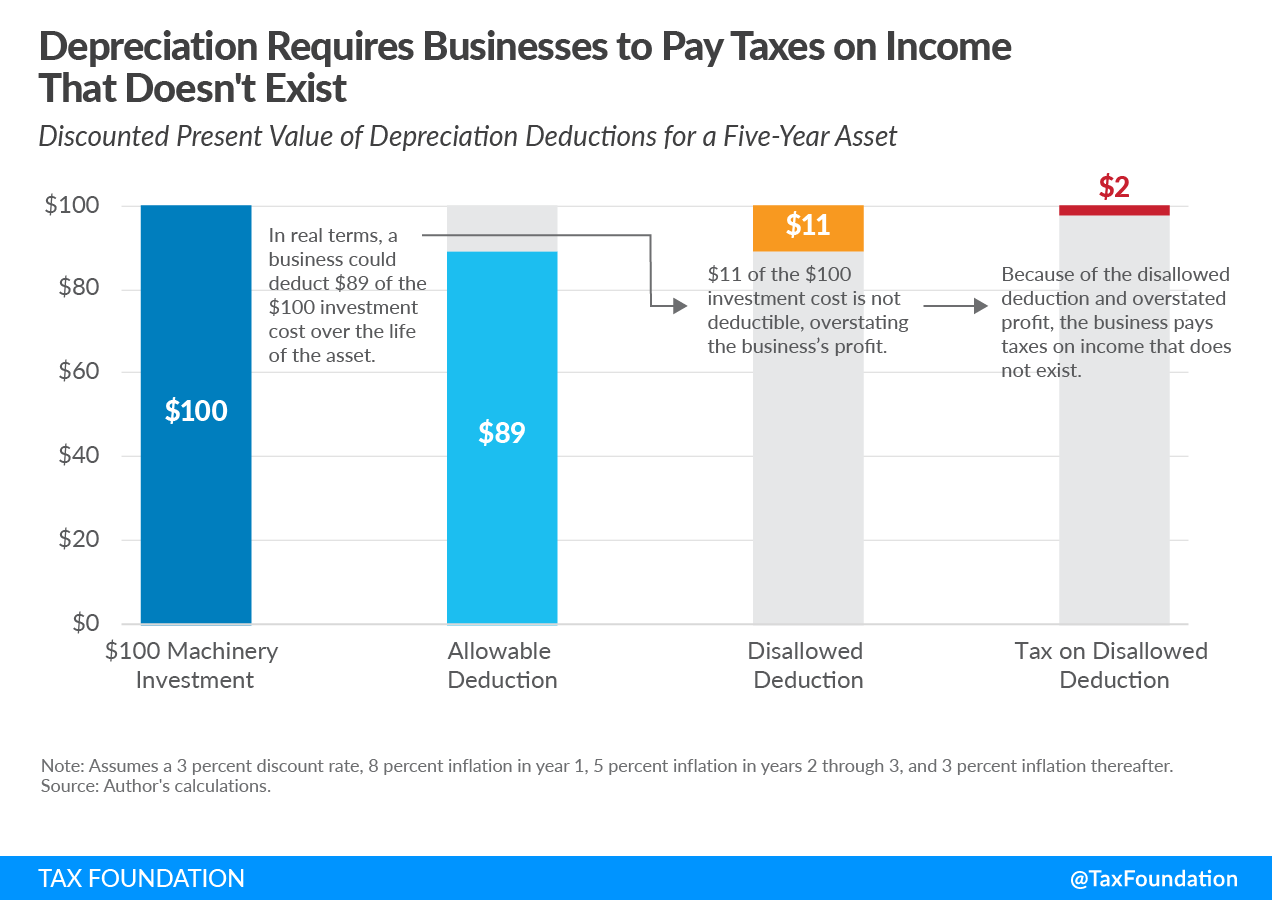

Bonus Depreciation Effects Details & Analysis Tax Foundation, The tax cuts and jobs act (tcja) included a statute stating that qualified purchases made between september 27, 2017, and january 1,. Dive into real estate tax strategies for 2025 including date placed in service, capital improvements vs repairs and maintenance, depreciation, cost segregation, the 100%.

How to Use Bonus Depreciation in Real Estate Most Efficiently, While this is a huge advantage to landlords, 100% bonus depreciation will phase out at the end of 2025 and will decrease incrementally by 20% a year until 2027 and beyond when it will be 0%. This means that if you buy.

Bonus Depreciation for Real Estate Professionals Tax WriteOffs, Bonus depreciation is a tax incentive that allows businesses, including real estate investors, to deduct a substantial percentage of the cost of qualifying assets in. 7024, the tax relief for american families and workers act of 2025, which includes 100% bonus.

The Multifamily Real Estate Experiment Podcast on LinkedIn Bonus, The 100% bonus depreciation in. You can only claim the asset’s standard depreciation.

Depreciation Planning for Real Estate LikeKind Exchanges Sikich LLP, In 2025, the rate for bonus depreciation will be 80%. For 2025, businesses can take advantage of 80% bonus depreciation.

The Basics of Depreciation For Real Estate Rental Property Fluent, In 2025, the rate for bonus depreciation will be 80%. Bonus depreciation is a tax incentive that allows businesses, including real estate investors, to deduct a substantial percentage of the cost of qualifying assets in.

The bonus depreciation deduction under section 168(k) begins its phaseout in 2025 with a reduction of the applicable limit from 100% to 80%.